Nifty 50:- Many investors wonder that despite there being thousands of companies in the stock market, why are the shares of only 50 companies included in the NIFTY index?

So let us tell you that there are more than 7000 companies listed in the entire stock market, NSE and BSE, out of which the market capitalization of 50 shares of NIFTY50 alone is more than 60% of the entire market. And this is the reason why only Top 50 companies have been kept in Nifty because these companies take the market up and also bring it down. Therefore, why only 50 companies have been included in NIFTY, it is because based on the performance of the top 50 companies included in NIFTY, it is decided whether the stock market will rise or fall.

Who Keeps 50 Companies in Nifty?

Now this question should come in your mind that if there are stocks of 50 companies in NIFTY, then who has decided that only 50 companies will be kept… Is there any other official in the stock market who decides which index? How many shares can I hold? If we look at it logically, this question is absolutely legitimate which definitely comes in the mind of a new investor.

So let us tell you that an index committee has been formed to select the companies of NIFTY 50, which keeps checking from time to time as to which company’s shares are to be included in Nifty 50 and which company’s shares are to be taken out. Because only 50 shares can be held in it, which was decided at the time of establishment of Nifty.

So when the business of any company included in NIFTY is not performing well then it is taken out of the NIFTY50 index and in its place comes the share of a company whose business is performing well but which share will be taken out and It is very difficult to choose which share will be included in the index because many factors are considered for this. And all these decisions are decided by the index committee only.

Example of Nifty:-

Suppose if yesterday the value of Nifty was 19000 points and today some bad news comes in the global market, then the impact of that news will be negative on the Indian stock market also. That is why when the stock market opens today, there are many chances that the value of Nifty will also fall.

This means that NIFTY may fall from 19000 to 18500 points or even lower.

Similarly, if there is any good news in the global market then Nifty can increase from 19000 to 20000.

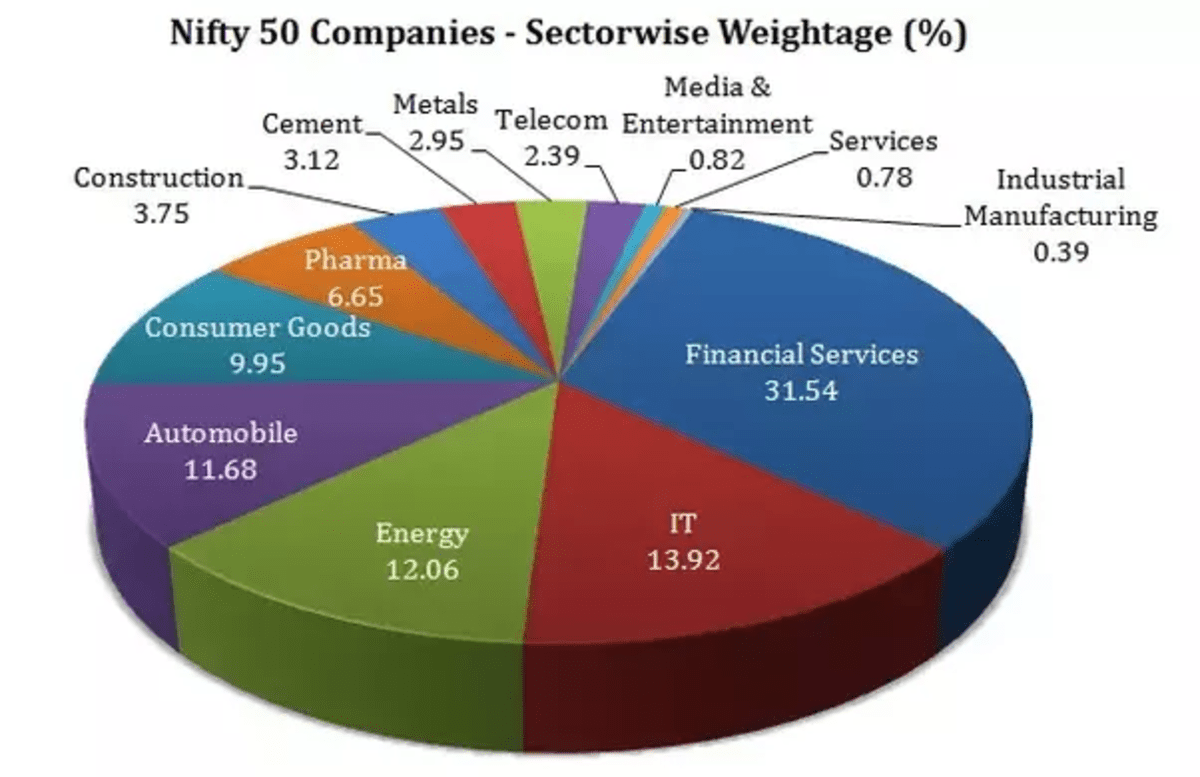

Reliance Industries, TCS, HDFC Bank, Infosys and Hindustan Unilever are the 5 largest companies among the top 50 companies of NIFTY 50. Of these, Reliance Industries alone has more than 10% weightage in the entire Nifty index.

I hope now you have understood Nifty meaning with example. Let us now know –

What Do You Know by Looking at Nifty?

If today the Nifty index has increased by some percent (%), it means that there are more buyers in the stock market, that is, people are bullish in the stock market, which means investors are positive about the stock market.

On the other hand, if some day Nifty index goes down by some percent (%) then it means that there are more sellers in the stock market i.e. people are bearish in the stock market which means investors are negative about the stock market.

If Nifty 50 index keeps going up continuously for a few days then it means that Bull Market is going on and if Nifty index keeps going down for some days continuously then it means that Bear Market is going on.

How Does Nifty Move Up and Down?

You might know that the value of Nifty keeps going up and down in the stock market every day, but why does this happen, that is, what are the reasons that keep Nifty going up and down? Let us know about these reasons –

When Does Nifty Rise?

1. Nifty increases when there are more buyers than sellers in the stock market.

2. Investors are positive about the stock market

3. Companies are performing well

4. The country’s economy is doing well

5. Any good news comes in global markets,

6. When the country’s budget is good.

7. When does Nifty decrease?

Nifty falls or decreases when –

1. There are more sellers than buyers in the stock market

2. Investors are negative about the stock market

3. Companies are performing poorly

4. The country’s economy is going down.

5. Any negative news comes in the global market

6. When the general public does not like the country’s budget.